7 Mistakes Charlotte Business Owners Make with Year-End Bookkeeping (and How to Fix Them Before Tax Season)

December is here, and if you're like most Charlotte business owners, you're probably looking at your books thinking "How did I get so behind?" Don't worry: you're not alone. Year-end bookkeeping trips up even the smartest entrepreneurs, but the good news is that most of these mistakes are totally fixable.

Let's dive into the seven biggest bookkeeping blunders I see Charlotte businesses make every year, plus practical solutions you can implement right now to get ready for tax season.

Mistake #1: Playing Hide and Seek with Bank Reconciliations

What's Going Wrong

Too many business owners treat bank reconciliation like that gym membership they never use: they know they should do it, but somehow it never happens. By December, you've got months of unreconciled transactions, mystery charges, and account balances that don't match reality.

Some folks rely on auto-feeds from their bank, thinking that's enough. But those feeds miss stuff: duplicate entries, bank errors, or transactions that got coded wrong. By year-end, your books could be off by hundreds or even thousands of dollars.

The Fix

Start reconciling every account monthly, not just when you remember. Set aside time each month to compare your accounting records with your bank statements, line by line.

For year-end prep, go back and reconcile the last few months if you haven't already. Make sure all December transactions are recorded properly and account for any checks that haven't cleared yet or deposits that are still in transit. Trust me, your future self will thank you when tax season rolls around.

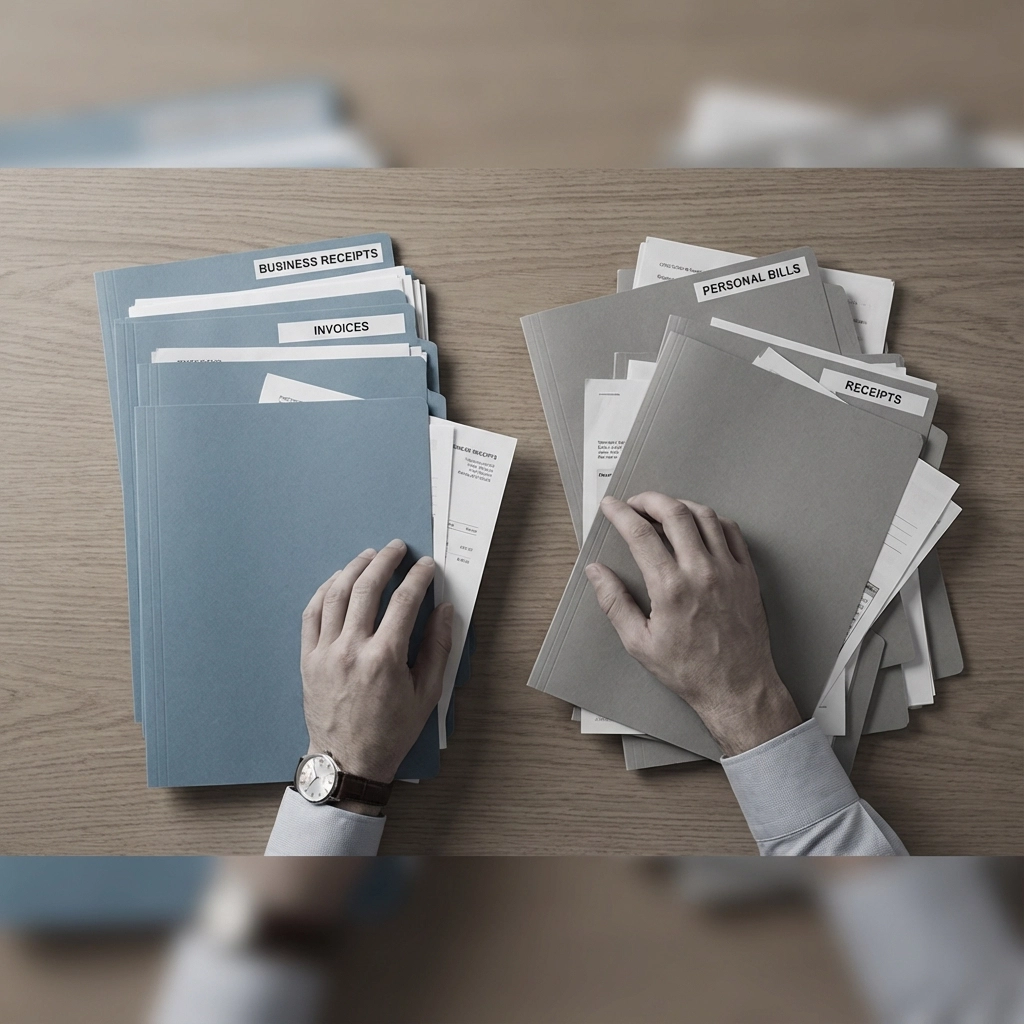

Mistake #2: The Personal-Business Money Mix-Up

What's Going Wrong

This one's a biggie. Using your business account to pay for lunch, or worse, mixing business expenses with personal credit cards. It happens more than you'd think, especially with small businesses where the owner wears all the hats.

The problem? It messes up your profit and loss statements, can cause issues with the IRS, and makes tax prep a nightmare. Come December, you're trying to untangle a year's worth of mixed-up transactions.

The Fix

Keep it simple: business stuff stays in business accounts, personal stuff stays personal. Get a business credit card and use it exclusively for business purchases.

If you've already got some mixed transactions, spend time in December going through everything and properly categorizing personal expenses. Create a clear reimbursement system for any legitimate business expenses paid from personal accounts, with receipts and documentation for everything.

Mistake #3: The "I'll Remember What That Was For" Trap

What's Going Wrong

You know how it goes: you buy something for the business in March, and by December you're staring at a $47.82 charge thinking "What the heck was that for?" Without proper expense tracking, you're losing legitimate tax deductions and making financial decisions based on incomplete information.

The Fix

Get organized now, not later. Use expense tracking apps that let you snap photos of receipts right when you make purchases. Most accounting software has mobile apps that make this super easy.

Before year-end, do a thorough review of all your expense reports. Make sure every business expense has proper documentation and is categorized correctly. If something looks weird or excessive, investigate it now rather than trying to explain it to your accountant in February.

Mistake #4: The "I'll Catch Up Later" Mindset

What's Going Wrong

Putting off financial record updates throughout the year creates a massive pile of work by December. You end up rushing through data entry, making mistakes, and still don't have accurate financial statements when you need them most.

The Fix

Stop procrastinating and update your records regularly: monthly is ideal, but weekly is even better. Assign specific times for data entry and stick to them like you would any other important business meeting.

If you're already behind, don't try to do everything at once. Break it down into manageable chunks: maybe tackle one month at a time. The key is to establish a routine going forward so you don't end up in this situation again next year.

Mistake #5: Sales Tax Confusion

What's Going Wrong

North Carolina sales tax rules can be tricky, especially for service businesses. Are you collecting sales tax when you should? Filing reports on time? Reconciling payments properly? Many Charlotte businesses either overpay or significantly underreport because they're not sure what applies to them.

The Fix

Before year-end, review your sales tax obligations carefully. Check that all sales tax you've collected throughout the year matches what you've reported to the North Carolina Department of Revenue. Make sure all your reports are filed and payments are up to date.

If you're not sure about your specific tax obligations, don't guess. Reach out to a local CPA who knows North Carolina tax laws: it's worth the investment to get it right.

Mistake #6: Cash Flow Chaos in Q4

What's Going Wrong

The fourth quarter hits different. You've got employee bonuses, higher utility bills, holiday marketing costs, equipment maintenance, and year-end inventory purchases all happening at once. Many businesses underestimate these pressures and end up scrambling for cash right when they need it most.

The Fix

Create a realistic Q4 cash flow projection that includes all your anticipated expenses: bonuses, equipment upgrades, increased operating costs, the works. Map out when money's going out and when it's coming in.

Don't let tax planning decisions create cash shortfalls. Work with your accountant to balance tax strategies with cash flow needs. Sometimes it's better to pay a little more in taxes than to create a cash crunch that could hurt your business operations.

Mistake #7: Playing Russian Roulette with Data Security

What's Going Wrong

In our digital world, poor backup and security practices can be devastating. System failures or security breaches in December could mean losing an entire year of financial records right when you need them for taxes. It's not just about convenience: it's about compliance and protecting sensitive financial information.

The Fix

Use cloud-based accounting software that automatically backs up your data. Most modern platforms like QuickBooks Online or Xero handle this for you, plus you can access your records from anywhere.

Make sure your financial data is secure both in your office and when team members are working remotely. Test your backup systems before year-end to make sure they're actually working. Don't wait until something goes wrong to find out your backups weren't happening.

Getting Back on Track

Here's the thing: you don't have to fix everything overnight. Pick the biggest problem area from this list and tackle that first. Maybe it's reconciling your bank accounts, or maybe it's separating personal and business expenses. Start there and work your way through the rest.

If this all feels overwhelming, that's normal. Consider bringing in professional help: whether it's a bookkeeper to get caught up or an accountant to review everything before tax season. At Hicks Bookkeeping Charlotte, we help Charlotte businesses get their books organized and keep them that way.

The most important thing is to start now. Every day you wait makes the year-end crunch worse. But with a little effort and the right systems in place, you can turn your bookkeeping from a source of stress into a tool that actually helps you run your business better.

Your future self: and your accountant: will definitely thank you for getting this handled before the new year hits.